OPPORTUNITY COST: AVOIDING THE REGULATORY RECAPTURE OF INNOVATION

INTRODUCTION: The High Price of a Missed Moment

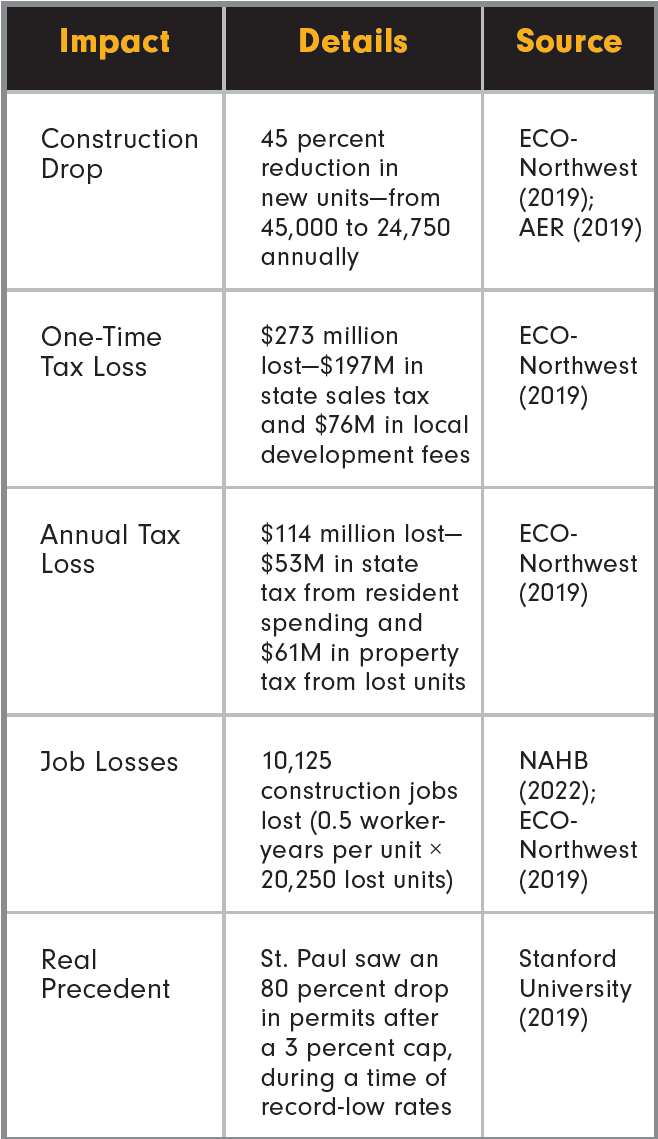

In 2019, St. Paul, Minnesota stood at the edge of a housing boom. With interest rates around 2 to 3 percent, capital was flowing, and developers had billions lined up for new apartments, townhomes, and job-creating projects. But in 2021, city officials imposed a strict 3 percent rent control cap, and the market’s response was immediate. Multifamily permits collapsed by 80 percent, derailing what could have been the city’s most productive housing cycle in decades (Stanford University, 2019; NAHB, 2022).

This wasn’t just a policy misstep. It was a textbook case of opportunity cost.

At a time when the national economy was primed for growth and financing was historically affordable, St. Paul opted out. Instead of housing, they got stagnation. Instead of private investment, they got capital flight. It’s a cautionary tale Washington should take seriously.

Today, Washington State stands at a similar crossroads. Median home prices exceed $600,000. Interest rates are twice what they were during St. Paul’s pre-crisis window. A national housing shortfall of millions of units (The Federal Housing & Urban Development (HUD), 2025) has turned affordability into the central economic challenge of our time. And yet, state lawmakers pushed for EHB 1217, which imposes statewide rent caps. This recreates very similar conditions that stalled St. Paul’s housing momentum.

Meanwhile, the federal government is opening the door to production. Opportunity Zones have already helped finance over 312,000 new homes nationally. Joint Task Forces are repurposing federal land for development. Modular multifamily housing is accelerating delivery timelines while reducing costs.

The question for Washington isn’t whether solutions exist. It’s whether we’ll embrace them, or allow them to be captured, delayed, and derailed by regulatory overreach and ideological rigidity.

SECTION 1: THE FEDERAL OPPORTUNITY LANDSCAPE

At the federal level, a strategic shift is underway. Instead of expanding legacy subsidy programs like the Low-Income Housing Tax Credit or Community Development Financial Institutions, the Trump administration is prioritizing market-driven tools designed to reduce costs, attract private investment, and deliver housing faster.

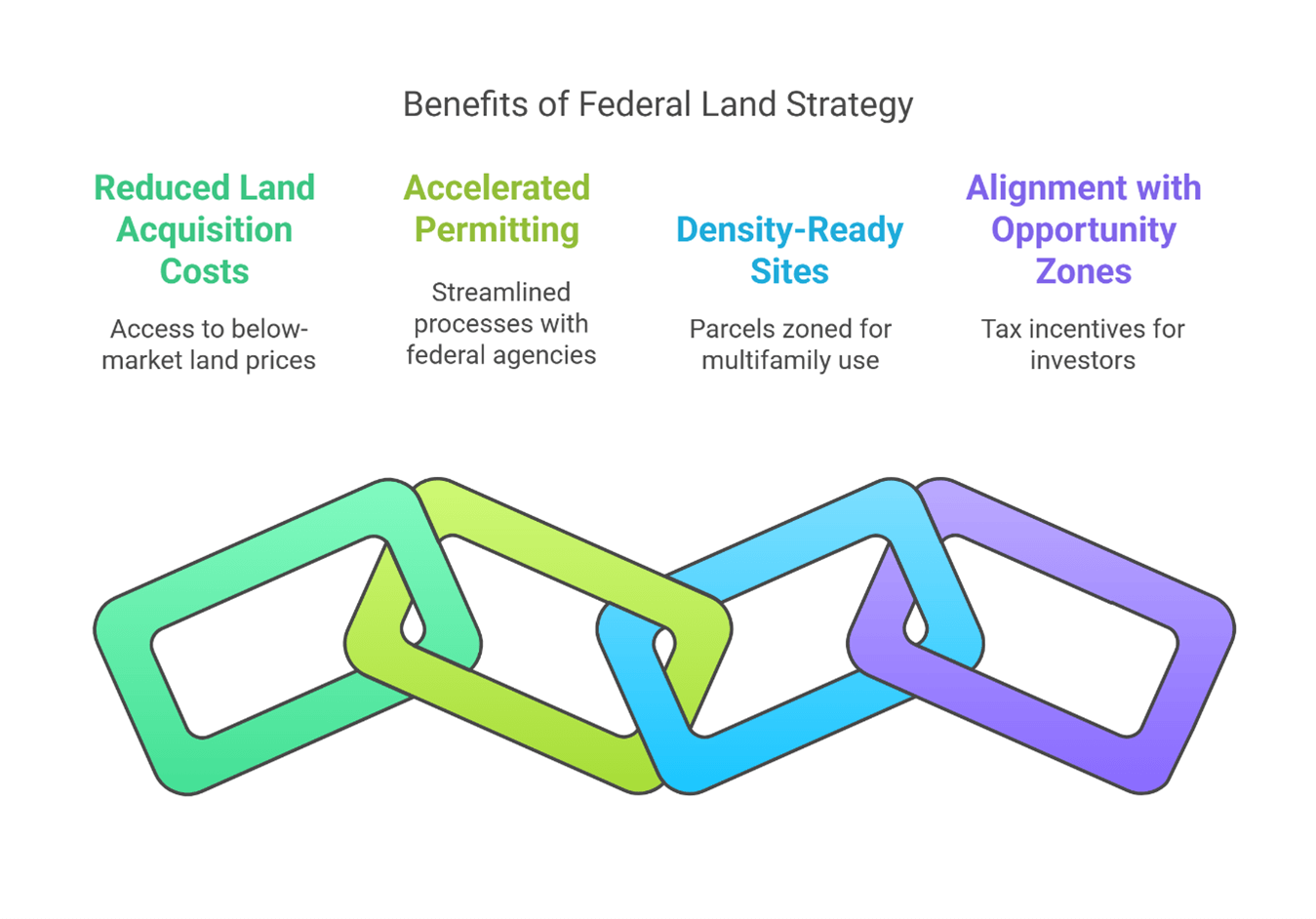

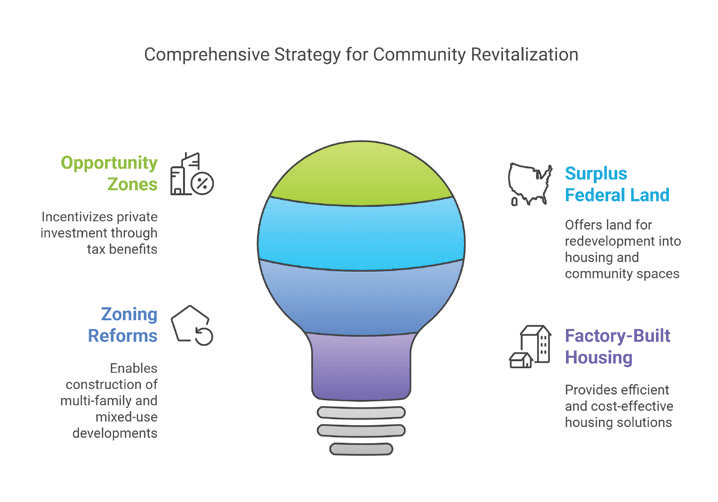

The three pillars of this new federal housing strategy are:

• Opportunity Zones (OZs) – Tax-incentivized investments in economically distressed communities

• Surplus Federal Land – Public land repurposed for residential development

• Factory-Built Housing – Modular construction to lower costs and accelerate delivery

HUD Secretary Scott Turner has described this shift as “moving from managing scarcity to enabling production.” The goal is to align federal assets and incentives with local housing needs, without perpetually expanding taxpayer subsidies. In Turner’s words, OZs and surplus land are now “the new federal baseline” for addressing housing supply and affordability.

The federal government owns roughly 640 million acres—about 28 percent of the entire U.S. landmass. While much of this is preserved for national defense, conservation, or parks, tens of thousands of acres are underutilized, including parcels in metro-adjacent regions such as Tacoma, Everett, and Spokane. In March 2025, HUD and the Department of the Interior launched the Joint Task Force on Federal Land for Housing, tasked with repurposing these sites for residential use. The initiative includes fast-track permitting, below-market land access, and prioritization of U.S. citizens, veterans, and vulnerable populations under Executive Order 14218.

Meanwhile, Congress is advancing H.R. 5761—the Opportunity Zones Transparency, Extension, and Improvement Act—which would extend key OZ tax benefits through 2028, reinstate basis step-ups, authorize fund-of-funds investment structures, and allow states to replace misclassified tracts with zones that reflect real economic need.These reforms are designed to make Opportunity Zones more effective, transparent, and scalable.

Taken together, these efforts represent a rare federal alignment: low-cost land, tax-sheltered capital, and fast-track construction methods—all greenlit by Washington, D.C.

The message to states is clear: if you’re ready to build, the federal government is ready to back you.

But the window is narrowing. EHB 1217, high interest rates, and capital flight threaten to choke off local momentum just as these tools become available. The next sections will explore each pillar in more detail, beginning with Opportunity Zones.

SECTION 2: OPPORTUNITY ZONES (OZs) IN ACTION

Now that the regulatory forest is being cleared, the question is not just what’s being removed, but what’s being planted in its place.

One answer already taking root is the federal government’s sharpened focus on Opportunity Zones. Created under the 2017 Tax Cuts and Jobs Act, OZs have matured beyond the pilot phase into the centerpiece of a national housing strategy. Under HUD Secretary Scott Turner—a former developer—the narrative has shifted. OZs are no longer framed as charity, but as a tax-incentivized, investment-led model for revitalizing overlooked communities.

“OZs are the federal government’s default approach to housing and economic development,” Turner said in a 2025 policy briefing. “They don’t depend on perpetual grants. They reward production, not process.”

What are Opportunity Zones?

OZs offer federal tax incentives for capital invested in designated low-income census tracts—139 of which are located in Washington State, including Seattle, Tacoma, Yakima, and Spokane. Capital gains reinvested in a Qualified Opportunity Fund (QOF) can benefit from:

• Deferral of the original gain until 2026 (or 2028 if pending legislation passes)

• A step-up in basis (5 to 15 percent reduction in taxable gain for long-term holds, if restored)

• Full tax exemption on appreciation for investments held ten years or longer

The purpose is clear: attract patient, private capital into underinvested areas, without the administrative friction of traditional housing subsidies.

What Has OZ Investment Achieved?

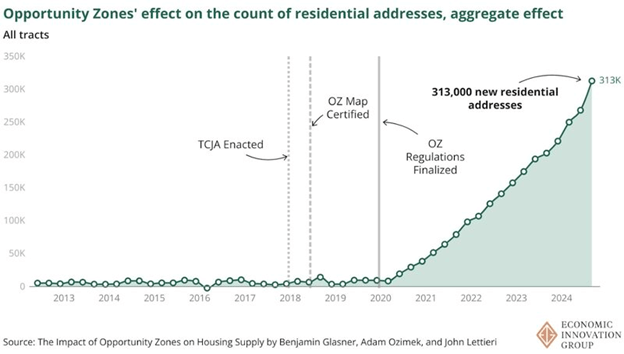

Between 2019 and 2024, Opportunity Zones catalyzed more than 312,000 residential units across the country, including roughly 4,957 units in Washington State (Glasner et al., 2025).

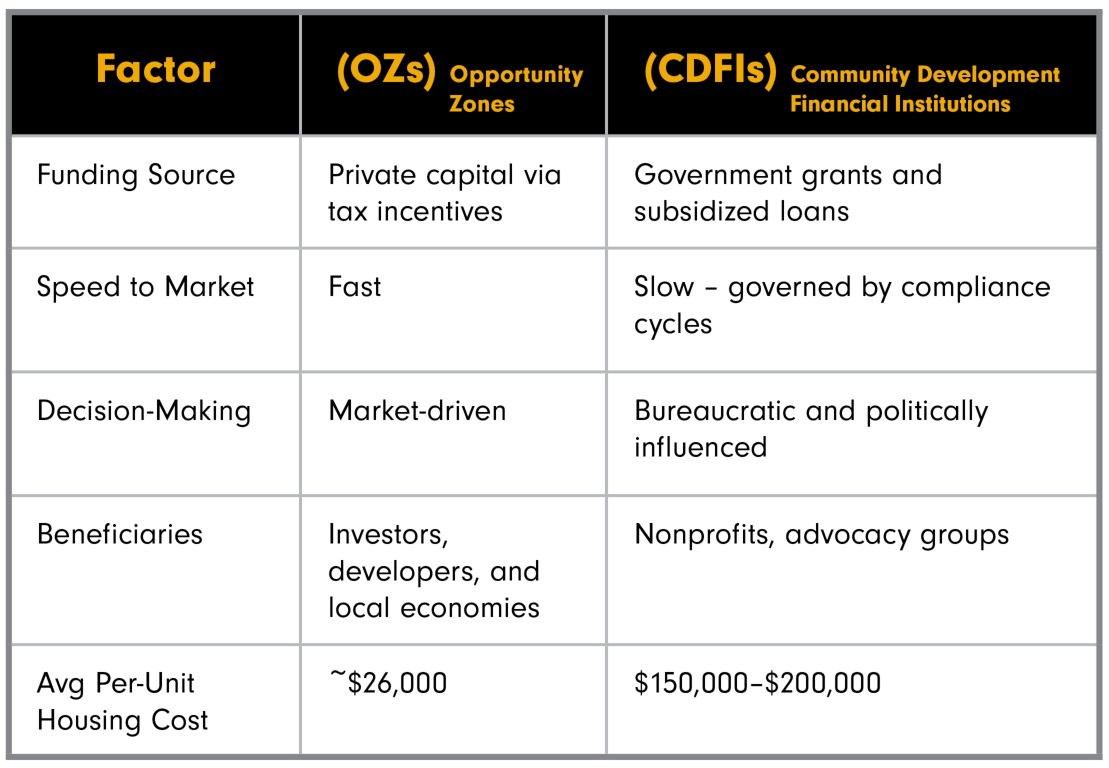

These units were delivered at an average federal cost of just $26,238 per unit, compared to $150,000 to $200,000 under LIHTC.

Beyond housing, OZ-designated areas have seen:

• Job growth between 3 and 4.5 percent, especially in construction and small business sectors

• 8.9 percent of all new residential addresses registered in OZ tracts

• A significant share of mixed-income and workforce housing, not just luxury development

Unlike traditional subsidies, OZs do not depend on recurring federal appropriations. They unlock private capital, reduce bureaucratic drag, and create a flywheel effect—reinvesting returns into future development.

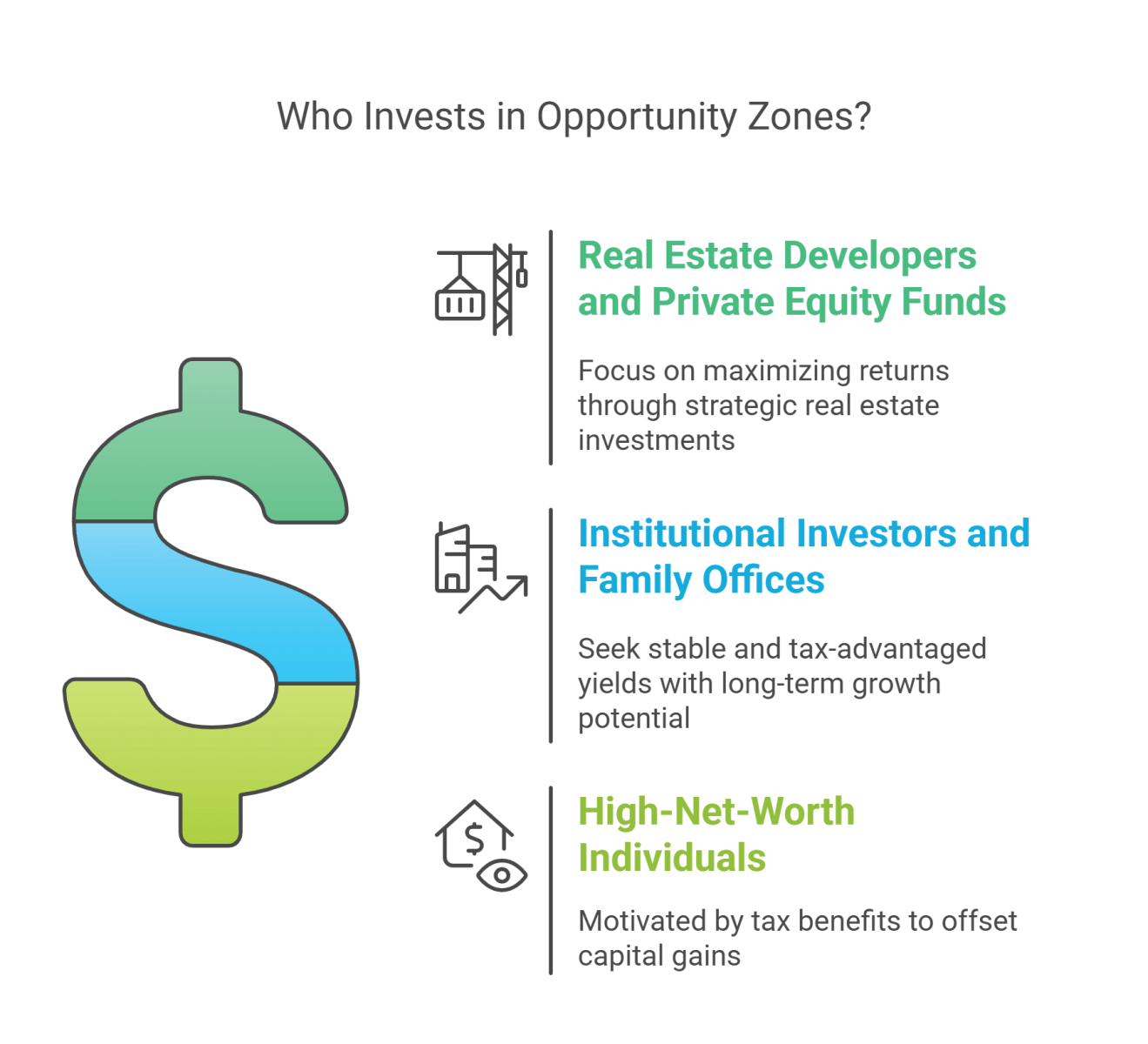

OZs vs. CDFIs: A Comparative Snapshot

The contrast is sharp. CDFIs often route funding through nonprofit intermediaries bound by mission constraints. OZs fund market-responsive, scalable development without compromising speed or cost efficiency.

Washington’s Next Moves

With H.R. 5761 likely to pass later this year—extending OZ tax benefits through 2028 and restoring key basis step-ups—Washington developers and rental housing providers have a narrowing window to act. Projects launched now can still capture the full 10-year hold and associated tax exemptions.

To maximize impact and returns, builders and investors should:

• Target OZ tracts in high-demand metros like Seattle, Spokane, and Everett

• Combine OZ capital with MFTE property tax exemptions

• Use modular or manufactured construction to shorten timelines and lower costs

• Monitor redesignation opportunities for new tracts in underserved areas

But momentum only matters if policy doesn’t reverse it. Rent caps under EHB 1217 could make even the most tax-advantaged deals too risky for capital to flow. Washington has shovel-ready zones, capital, and builders. The question now is whether policymakers will protect that alignment, or undermine it.

SECTION 3: UNLOCKING FEDERAL LAND FOR HOUSING

If Opportunity Zones are the investment engine, surplus federal land is the fuel source.

In March 2025, HUD Secretary Scott Turner and Interior Secretary Doug Burgum launched the Joint Task Force on Federal Land for Housing—a coordinated initiative to identify and release underutilized federal properties for residential development. Their mission is straightforward: unlock public land to expand private housing production, especially in urban areas where high land costs have become one of the biggest constraints on supply.

The scale is staggering. The federal government owns roughly 640 million acres—about 28 percent of the entire U.S. landmass. While much of this land is protected for conservation, defense, or recreation, tens of thousands of acres are classified as surplus or underutilized. Many are located in metro-adjacent areas like Tacoma, Everett, and Spokane. These parcels are now being fast-tracked for housing through federal disposition programs, streamlined permitting, and public-private partnerships.

“America needs more affordable housing, and the federal government can make it happen by making federal land available to build affordable housing stock,” wrote Secretaries Turner and Burgum in a March 2025 op-ed.

This is more than land reform. It is a supply-side strategy at the highest level of government.

Federal Vision vs. State Conflict

In Washington State, entitlement timelines can stretch for years, and land prices regularly exceed $1 million per acre in urban cores. Gaining access to federally owned land—even in smaller, scattered parcels—can dramatically shift the development equation. Many of these sites were previously used for logistics, warehousing, or administrative purposes and are now being reevaluated through a housing lens.

But there’s a catch: legal misalignment.

Executive Order 14218 prioritizes housing access for U.S. citizens, veterans, and vulnerable populations. However, Washington’s sanctuary policies (RCW 49.60.030) prohibit housing providers from inquiring about immigration status. This creates a direct legal conflict between federal eligibility requirements and state law. If unresolved, it could jeopardize HUD funding and disqualify local housing authorities and nonprofit partners from participating in federal surplus land programs.

At a moment when federal housing tools are aligning for production, Washington risks locking itself out.

Action Items for Builders and Policymakers

• Monitor HUD surplus land listings and subscribe to site release notifications

• Co-locate OZ tracts with federal land to maximize tax incentives and cost savings

• Use modular and manufactured solutions to reduce construction timelines

• Align local permitting systems with federal fast-track standards

• Seek clarification or alignment on EO 14218 to preserve program eligibility

SECTION 4: FACTORY-BUILT HOUSING – MODULAR, MANUFACTURED, AND THE NEW SUPPLY CHAIN

Even with the right land and the right tax incentives, housing doesn’t build itself. Most projects don’t die from a lack of ambition—they die from cost overruns, timelines, and permitting risk.

This is where factory-built housing changes the equation.

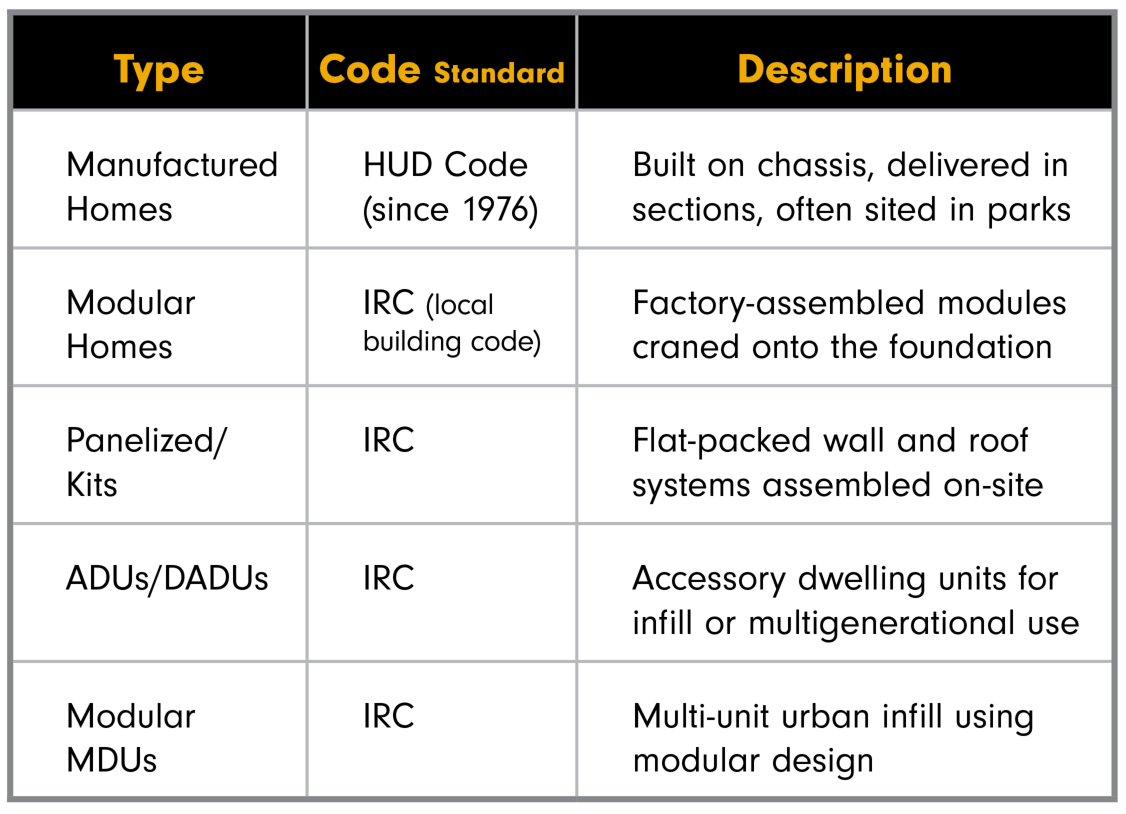

Often lumped under the “manufactured” umbrella, today’s off-site construction ecosystem includes several distinct housing types, each governed by different building codes, financing tools, and delivery models:

While manufactured homes remain vital in rural and exurban markets, it’s modular multifamily construction that is redefining urban housing potential in places like Spokane, Tacoma, and Seattle. These aren’t trailers—they’re high-quality, code-compliant homes and apartments delivered 20 to 30 percent faster and cheaper than traditional stick-built models.

Why Modular Works in 2025

Modular housing thrives under the precise pressures Washington developers face today:

• Interest rates at 6 to 7 percent, raising carrying costs

• 25 percent Canadian lumber tariffs inflating material prices

• Rent caps under EHB 1217 reducing expected revenue

• Labor shortages slowing conventional construction timelines

Factory-built construction mitigates these risks. Modular units are built in controlled environments, using tight construction envelopes, fire-resistant materials, and standardized processes that qualify for lower insurance rates and green financing. These attributes make modular particularly attractive to ESG-aligned capital and GSE-backed loan programs.

Fannie Mae treats modular housing as equivalent to site-built under its standard mortgage guidelines. Its HomeStyle® Renovation and MH Advantage programs support both new modular installations and upgrades. On the multifamily side, forward commitments from Fannie Mae have supported modular projects like The Stack in New York—proof that this method isn’t just efficient, it’s financeable at scale.

Washington’s Regulatory Progress

Several state and local reforms have laid the groundwork for modular adoption:

• E2SHB 1110 (2023) legalized duplexes to fourplexes statewide—ideal for modular small multifamily

• SB 5412 (2023) requires fast-track permitting for factory-built housing

• Local reforms in Seattle and Spokane have reduced or waived parking minimums, cutting up to $20,000 per unit

• Tacoma and Everett are exploring pre-approved modular plan sets

• Spokane is eliminating height restrictions, allowing greater density and housing types

These policies enable exactly the type of modular infill that can unlock workforce housing—quickly and at scale.

Barriers Still Holding Back the Model

Despite the progress, several barriers threaten modular’s ability to scale:

• Regulatory ambiguity: Confusion between the Residential Landlord-Tenant Act (RLTA) and the Manufactured Housing Landlord-Tenant Act (MHLTA) can delay permitting or derail appraisals

• Insurance and financing inconsistency: Some lenders and underwriters still treat modular as a “special product” instead of standard construction

• Rent caps under EHB 1217: Suppressed revenue potential makes even modular sixplexes on free land financially unviable in workforce housing markets

Unless these issues are addressed, Washington risks rendering even its most shovel-ready housing strategies economically obsolete.

What Smart Developers are Doing Now

• Targeting surplus federal land and Opportunity Zones for low-cost, high-leverage sites

• Using modular methods to hedge against cost inflation and labor risk

• Bundling projects with green features to unlock ESG and GSE financing pathways

• Engaging legal and appraisal experts early to ensure proper classification and optimal loan terms

Modular Is Ready. Is Washington?

In a world of constrained capital, speed, efficiency, and predictability are the new currency of housing production. Modular delivers on all three and positions Washington to build the thousands of new homes already legalized through state zoning reform.

But even the best tools cannot succeed if regulation strangles their application. Washington doesn’t just need new tools—it needs a clear runway to use them.

SECTION 5: THE REGULATORY STAKES

For all the momentum coming from Washington, D.C., it may be Olympia that brings the housing engine to a halt. EHB 1217, Washington’s rent control law, risks repeating the collapse seen in St. Paul—only in a more expensive, more constrained, and more regulated environment. The bill caps annual rent increases at 7 percent plus CPI (or 10 percent, whichever is lower) for standard rentals, and 5 percent for manufactured homes. These caps may sound moderate, but in one of the tightest markets in the country, they function as hard price ceilings with real economic consequences.

The bill passed the Senate in April 2025. If signed into law, the impact on development, tax revenue, and job creation will be immediate.

The Cost of Missed Momentum

Developers will not wait to test their margins. According to economic modeling, EHB 1217 would:

These are not speculative forecasts. They reflect standard tax multipliers, real permit data, and economic elasticity models. St. Paul’s collapse happened when capital was cheap. Today, interest rates are double what they were then.

Federal Conflict: HUD Compliance at Risk

EHB 1217 doesn’t just undermine capital flows. It may also trigger a direct legal conflict with federal housing policy.

Executive Order 14218 requires immigration status verification for HUD-funded programs. Washington’s state law (RCW 49.60.030) prohibits housing providers from inquiring about immigration status.

Without resolution, this contradiction could:

• Disqualify Washington from receiving federal housing grants

• Bar participation in HUD surplus land programs

• Expose local housing authorities to legal liability when accepting federal funds

At the very moment federal support is aligning, Washington could cut itself out of eligibility.

Innovation at Risk

The rise of modular housing, ADUs, and small infill projects hinges on predictable returns and fast permitting.

Rent caps affect more than just luxury high-rises—they jeopardize low-margin, high-impact projects that are finally viable thanks to zoning reform, OZ financing, and access to federal land.

Without reliable revenue, even a modular sixplex on free land becomes unfinanceable.

Meanwhile, confusion between the RLTA and MHLTA continues to stall modular and manufactured housing. Misclassification during permitting or appraisal delays construction and complicates financing. Clarifying these definitions is essential to ensure new forms of housing aren’t buried in old regulations.

SECTION 6: WASHINGTON’S CHOICE

Washington sits at a rare inflection point. The elements of a new housing model are in place:

And yet, all of this progress stands to be undone by one piece of legislation: EHB 1217.

And yet, all of this progress stands to be undone by one piece of legislation: EHB 1217.

In today’s market—where capital is constrained, borrowing costs sit at 6 to 7 percent, and materials are burdened by a 25 percent tariff—Washington cannot afford to make new housing less viable. The collapse of new construction in St. Paul wasn’t just a local failure. It was a lost decade of housing, jobs, and community growth.

If we repeat that mistake here, the damage will be worse.

Unlike 2021, we’re no longer in a zero-interest-rate environment. Investors now demand certainty. They seek speed, scale, and legal alignment. If Washington becomes inhospitable to capital, that capital will go elsewhere—and take jobs, tax revenue, and housing supply with it.

What Must Be Done

To keep the housing engine running, Washington must:

• Reject or repeal EHB 1217 to preserve housing investment and supply

• Align state law with Executive Order 14218 to avoid disqualification from federal housing programs

• Expand SB 5412’s fast-track permitting for factory-built housing

• Clarify RLTA and MHLTA classifications to streamline modular development

• Seek relief from international material tariffs to lower construction costs

• Maximize federal tools like Opportunity Zones and surplus land for site access and financing efficiency

This isn’t about ideology. It’s about arithmetic.

Washington needs production, not price ceilings. It needs faster construction, not more red tape. It needs to welcome investment, not chase it away with contradictory policies and legal conflicts.

St. Paul missed the boom. Let’s not miss what’s next.

SOURCES CITED

-

Diamond, R., McQuade, T., & Qian, F. (2019). The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco. American Economic Review. https://www.aeaweb.org/articles?id=10.1257/aer.20181289

-

ECONorthwest. (2019). Multifamily Housing & Rent Control: Economic Analysis for Washington State. https://www.econw.com

-

National Association of Home Builders (NAHB). (2022). Economic Impacts of St. Paul’s Rent Control. https://www.nahb.org

-

Stanford University. (2019). Economic Impacts of Rent Control.

-

Washington State Department of Commerce. (2024). Housing Supply Needs Assessment. https://www.commerce.wa.gov

-

U.S. Census Bureau. (2023). State-to-State Migration Flows: Washington Net Migration. https://www.census.gov

-

Internal Revenue Service. (2024). Opportunity Zones FAQs. https://www.irs.gov

-

Economic Innovation Group – Glasner, B., Ozimek, A., & Lettieri, S. (2025). Opportunity Zones and Housing Supply Report. https://eig.org

-

Corinth, K., Diamond, R., & Moretti, E. (2025). Place-Based Policies and Economic Development. National Bureau of Economic Research.

-

Fikri, K., Lettieri, S., & Haggerty, M. (2023). The Impact of OZ Investment on Local Economies. Economic Innovation Group.

-

HUD.gov. (2025). Joint Task Force on Federal Land for Housing Development. https://www.hud.gov

-

Seattle.gov. (2025). MFTE Program, Zoning and Parking Reform Documentation. https://www.seattle.gov

-

Modular Building Institute. (2025). The Case for Modular Construction. https://www.modular.org

-

Fannie Mae. (2025). HomeStyle® Renovation, MH Advantage®, and Modular Toolkit Resources. https://singlefamily.fanniemae.com

-

Washington State Legislature. (2025). EHB 1217 Conference Committee Reports. https://app.leg.wa.gov

-

RCW 49.60.030. Washington Law Against Discrimination. https://app.leg.wa.gov/default.aspx?cite=49.60.030

-

Executive Order 14218 (February 2025). Ending Taxpayer Subsidization of Open Borders. https://www.whitehouse.gov

-

YIMBY Action. (2025). Modular Housing Advocacy & EO 14151 Commentary. https://www.yimbyaction.org

-

Boston Review. (2023). Opportunity Zones and Gentrification Analysis. https://www.bostonreview.net

-

Joint Op-Ed by HUD Secretary Scott Turner and Interior Secretary Doug Burgum. (2025). Wall Street Journal – “Federal Land Can Be Home Sweet Home.”