Legal Use of Deposits at Move-Out

We often hear from members who are not aware of the strict laws governing collection and return of the Security Deposit. Penalties include a full refund of the deposit (no matter what damages were caused by the tenant), and sometimes double the amount of the deposit. Many are clear on the old laws, but were unaware they changed in 2023 to include the following:

- The term “normal wear and tear” is replaced by “wear resulting from ordinary use” which is defined in the code under RCW 59.18.030: “Wear resulting from ordinary use of the premises" means deterioration that results from the intended use of a dwelling unit, including breakage or malfunction due to age or deteriorated condition. Such wear does not include deterioration that results from negligence, carelessness, accident, or abuse of the premises, fixtures, equipment, appliances, or furnishings by the tenant, immediate family member, occupant, or guest.

- Maximum time for the landlord to mail deposit accounting statement is extended from 21 days to 30 days after move-out.

- Documentation (invoices, receipts, estimates, etc.) of all repair and cleaning costs must be attached to the refund statement.

- No portion of any deposit may be withheld for carpet cleaning without documentation of condition that is beyond wear resulting from ordinary use of the premises.

- Charges for repairs on items where condition was not reasonably documented on the move-in checklist are prohibited.

- For leases beginning on or after July 23, 2023, there is a three-year statute of limitations to recover damage sums exceeding the security deposit.

One of the most common missteps for inexperienced housing providers is the handling of the deposit at move-out. WA State law requires housing providers to mail any deposit refund along with an accounting of charges for damages and receipts or other documentation of related costs to the tenant within 30 days of moving out (or a shorter period if specified in the lease or local law). A property condition report comparing move-in condition to move-out condition must be included with this statement. These laws apply to any deposit that is held during the tenancy, including a general security deposit, pet deposit, or damage deposit. Take the following ten steps to limit your risk of dispute and unpaid damages.

1. DO NOT ACCESS THE DEPOSIT DURING TENANCY

The deposit must only be accessed by the housing provider in compensation for legitimate damages after the tenant moves out. Do not access the funds for any reason during the tenancy, even if the tenant requests it. If the tenant owes you money for repairing a broken window during tenancy, simply send them an invoice. If one resident moves out and others remain, they need to work out transferring their share of the deposit on their own. The deposit refund accounting must be handled in a very specific way under the law, and it is best not to complicate matters.

2. MAKE EXPECTATIONS CLEAR BEFORE MOVE OUT

Use RHAWA’s Move-Out Instructions to make sure the tenant understands they will be charged for any cleaning that is not done per your specifications. This is also a good way to clarify the move-out timeline, return of keys, the designated tenant if there are unrelated roommates, and getting their forwarding address.

3. BEGIN COUNTING THE 30-DAY REFUND PERIOD THE DAY AFTER MOVE OUT

If you do not mail the deposit accounting and any refund by 30 days after move-out (or a shorter period if specified by the lease or local law), you must return the full deposit, or a judge could award double damages to the tenant. Therefore, it is important to establish the day when the tenant relinquishes the premises back to you. RCW 59.18.280 states:

“Within 30 days after the termination of the rental agreement and vacation of the premises or, if the tenant abandons the premises as defined in RCW 59.18.310, within 30 days after the landlord learns of the abandonment, the landlord shall give a full and specific statement of the basis for retaining any of the deposit, and any documentation required by (b) of this subsection, together with the payment of any refund due the tenant under the terms and conditions of the rental agreement.”

In most cases, the first day of the 30-day period is the day after the last day of the rental term, and the tenant moves out and returns keys as planned. Here are some other examples that would count as your first day of the 30-day period:

- The tenant tells you they need two extra days to move out after the end of the term or rental period, and you agree to allow them with a prorated rent charge. Begin counting the day after they are moved out and have returned the keys.

- The tenant moves out before the end of the term but does not notify you or return keys. Once confirmed (via abandonment notice or inspection), begin counting the day after confirmation.

- The tenant breaks the lease and moves out early. Even if the lease continues until you find a new tenant, begin counting the day after they return keys.

4. DOCUMENT “BEFORE AND AFTER” CONDITION OF THE PROPERTY

In order to complete the property condition report, you must have a copy of the Property Condition Checklist signed by the tenant at move-in. If you do not have this report, you cannot legally retain any of the deposit for property damages. (Note: If you realize you are missing this report mid-tenancy, inspect and complete the form, noting that the deposit will only be used for damage between the inspection and move-out.) Once the tenant moves out, complete a thorough inspection of the property and document all changes in condition by completing the move-out section of the Property Condition Checklist started at move-in. Take photos of any damaged areas.

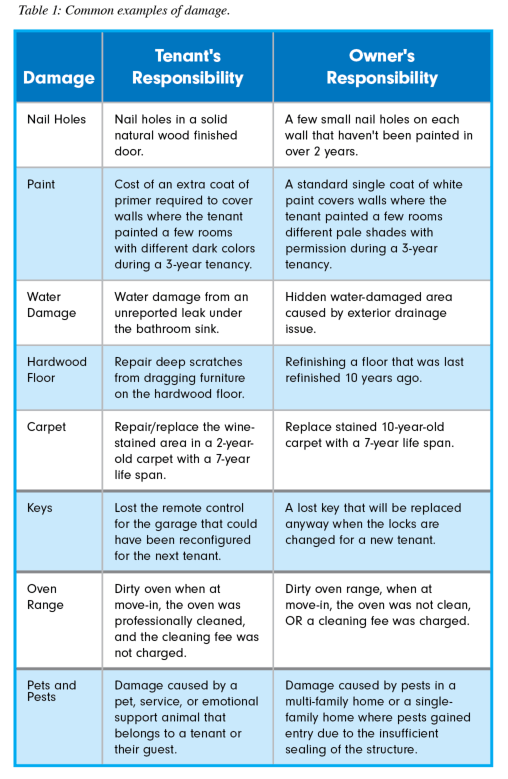

5. ONLY CHARGE THE TENANT WHEN THEY ARE LEGALLY RESPONSIBLE

It is important to only deduct funds from the deposit when the tenant is responsible for the damage. The tenant is responsible for damage to the property from accidents, negligence, and inappropriate use. The housing provider is responsible for maintaining the property and any damage caused by ordinary use of the premises.

Keep a full and specific account of charges for damages.

RCW 59.18.280 requires you to provide a full and specific statement of all charges to the tenant at move-out and documentation of costs (receipts, invoices, estimates, etc.). Assemble the completed Deposit Refund Statement, all documentation, and refund payment, then make a copy of everything for your files.

Go through the Property Condition Checklist and indicate where there is damage that was the fault of the tenant due to accident, negligence, or inappropriate use. Do not charge the tenant for wear from ordinary use or damage resulting from a maintenance issue that was your responsibility.

Carpet Cleaning

The law now prohibits withholding any deposit for carpet cleaning without documentation of a condition that is beyond wear resulting from ordinary use of the premises. Keep in mind that routine cleaning is part of "ordinary use," and a lack of cleaning is considered “negligence.” If it looks like the tenant has never vacuumed, you can certainly charge for cleaning. And if you ask them to clean the carpet at move out, that is also a reasonable expectation given ordinary cleaning expectations to vacuum high-traffic areas frequently, vacuum all areas on a routine schedule, clean spots and spills quickly with non-damaging products, and professionally deep clean every 12 to 18 months (Source: http://carpet-rug.org/carpet-for-homes/cleaning-and-maintenance/). Just don't deduct from the deposit for cleaning a clean carpet!

Only Charge for Lost Use

Refer to the manufacturer or vendor's life-span estimates and only charge for lost use when replacement is required. For example, if a 5-year-old refrigerator with a 10-year lifespan must be replaced due to tenant damage like a broken door, charge the tenant 50% of the cost. The same example would apply with hardwood floor refinishing, where the vendor guaranteed the finish for 10 years of normal use. If tenant damage devalues your property but you choose not to make the repair at move-out, it is inadvisable to charge the tenant for devaluation or what a repair might cost. See the HUD Damage Claim Form for more examples of normal wear and tear, as well as a life expectancy chart for common household items.

6. DO YOUR BEST TO COMPLETE THE WORK WITHIN THE 30-DAY WINDOW

Make every effort to complete all repairs and cleaning that will be charged to the tenant within the 30-day period. Only after failing to remedy damages within the 30 days while making every conceivable effort, you may mail a preliminary deposit refund statement showing all charges to date, along with a letter explaining the remaining damages which have not been completed, and an estimated date for their completion. Issue the final deposit refund statement based on final charges as soon as possible.

7. CHARGE DIFFERENT DEPOSITS APPROPRIATELY

A general “Security Deposit” can be applied toward anything the tenant owes you at move-out. If you collected a separate “Pet Deposit” (or something like that), you can only use those funds for the type of damage specified. If you collected “Last Month’s Rent,” you can only apply those funds to the last month of rent, even if they still owe you utilities or rent from previous months. Best practice is to just have one general Security Deposit, unless a local law limits the amount (several cities limit the deposit to one month’s rent) and you are permitted to charge extra for a pet deposit or last month’s rent.

8. THOROUGHLY DOCUMENT ALL CHARGES

Keep all communications and receipts related to work completed. The law requires you to provide a full and specific statement of all charges to the tenant along with copies of receipts, invoices, estimates, labor log, or other documentation of repair and cleaning-related costs.

If you are charging for work you did yourself, use the hourly rate you listed in your lease under section 3.E. of the RHAWA lease form and include a detailed log of your time. Assemble the completed Deposit Refund Statement, all documentation, and any refund payment, then make a copy of everything for your files before mailing it to the tenant.

9. MAIL STATEMENT AND REFUND TO TENANT AT LAST KNOWN ADDRESS BY THE DUE DATE

The law requires that you mail the statement, documentation, and any refund to the tenant’s last known address via USPS First Class Mail within 30 days of move-out. If you do not mail the statement on time, you cannot legally keep any of the deposit, and a judge may award the tenant double damages, requiring you to return the full deposit and pay the tenant additional funds equal to the full deposit amount.

- If you have sent the refund digitally or using another method with the tenant’s agreement, include a statement to that effect.

- If you choose to send an additional copy using another method, such as Certified Mail or a delivery service such as FedEx, you still must send a copy via USPS First Class Mail to fulfill your duty under the law.

- If you have multiple unrelated tenants on the same lease, the best practice is to provide one Deposit Refund Statement and a check payable to all persons who signed the lease and mailed to a designated address (unless you have ALL agreed in writing to another arrangement).

- If you have not established a designated forwarding address and cannot get this information from the tenant prior to the due date, list all tenant names and mail to the rental property address using regular USPS First Class Mail. If they have completed mail forwarding instructions for the post office, it will be forwarded to them. If not, at least you have documentation that you did everything in your power to deliver the statement on time and have fulfilled your duty under the law.

In all cases, document that you mailed the statement and any refund by taking pictures and/or by asking the post office for a certificate of mailing. If the deposit does not cover all the charges, list the amount owed on the Deposit Refund Statement. If they do not pay, you may send follow-up letters and then handle it through Small Claims Court or collections as needed.

10. RESPOND TO DISPUTES FAIRLY & THOUGHTFULLY

If a tenant disputes any charges, address their concern carefully. Make sure to investigate anything they call into question, such as a claim that they reported a leak or that something broke because it was old and worn out, not due to misuse by them. Make any adjustments to the statement and send any additional refund as soon as possible.

Deposit return issues are the most common landlord-tenant dispute. Keep in mind that it is your responsibility to maintain your property under ordinary use by a tenant. That means you will need to replace major appliances, carpet, paint, etc., on a regular basis at your own expense. Also, remember that a deposit by definition is always fully refundable and that most tenants rely upon the return of the deposit in order to secure their next residence. If they have obviously made a good effort to return the home in good, clean condition, do not charge them unnecessarily. These days, a dispute is more likely to end in the tenant’s favor and will only cause additional strain on your valuable time and resources.