The Ultimate Guide to 2nd Lien Loans (HELOCs and HELOANS)

Do you have a property with a mortgage that you never want to pay off because it has such a low interest rate, but feel stuck because you have so much equity behind it that you’d want to tap into? In this article, you’ll learn the different ways you can pull out cash while keeping that mortgage.

DEFINITION

A 2nd lien loan (also called a second mortgage) is a loan on a property that has an existing mortgage (the 1st lien loan). Being in 2nd position means that it gets 2nd priority in terms of repayment. If the borrower defaults and the property is foreclosed, the 1st lien gets paid off first, and then the 2nd lien gets paid with whatever is left over, which is why it’s considered riskier for lenders and thus why 2nd liens are more expensive than a 1st lien.

There are also 3rd lien loans, 4th lien loans, etc., but generally, you’re not going to get this from a bank (usually only a private lender) due to the extreme level of risk.

CASH-OUT REFINANCE VS. 2ND LIEN

Technically, putting a 2nd lien on a house you already own is considered a cash-out refinance, but most people use that term to mean putting a 1st lien mortgage on a property. A cash-out refinance is anytime you’re putting a loan on a property and you get cash back (usually at least $2,000 is the threshold, otherwise it’s considered a rate-term refinance). It doesn’t matter if the property has a mortgage or not (i.e., it’s free and clear); if you are getting cash out at closing, then it’s considered a cash-out refinance.

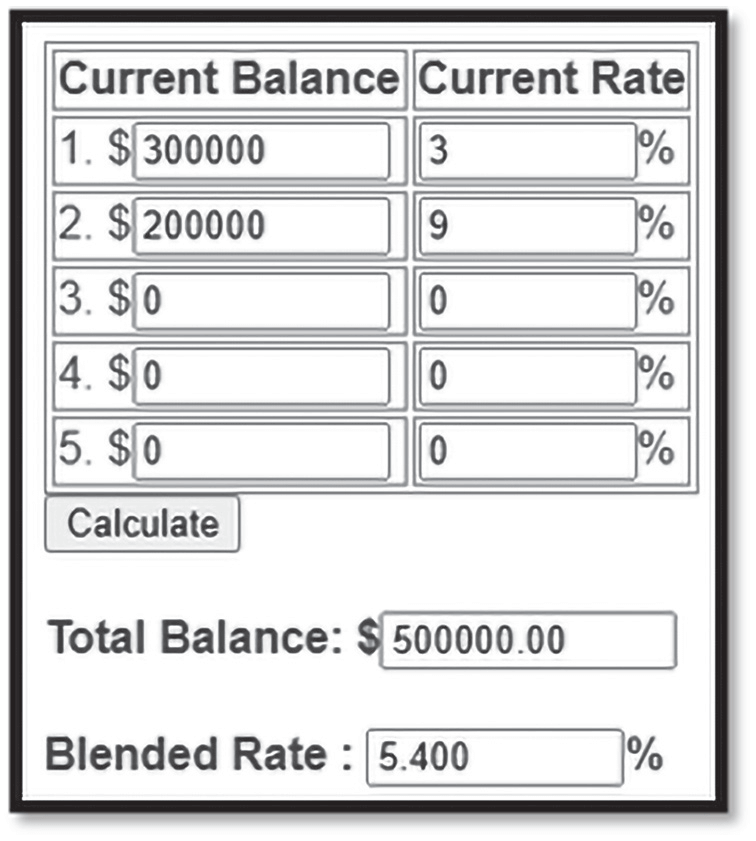

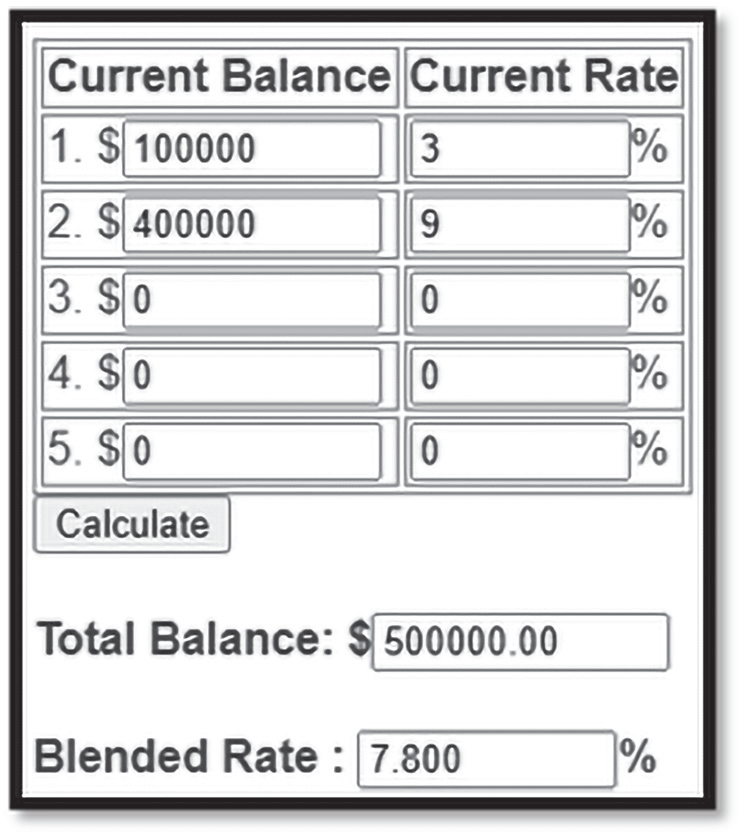

So, how do you know whether it’s better to do a full cash-out or to just put a 2nd lien on the property? This is where the blended rate analysis comes into play. I Googled “Blended Rate Calculator” and am using the first website that came up: https://www.drcalculator.com/calc/blended.html

Let’s say you need to pull out $200k on a house and have a $300k first mortgage. If you were to get a 2nd lien loan at 9% and the 1st is at 3%, then your blended rate is 5.4% on $500k. You can’t do a 1st lien cash-out refinance at 5.4% in today’s market, so the 2nd lien cash-out makes sense.

Now let’s say that you need a $400k cash-out and have a $100k mortgage. The blended rate becomes 7.8% on $500k, so I’d say it’s probably worth paying off the 1st mortgage and doing a cash-out refinance because rates on a primary residence today are in the 6’s.

Right now, for most folks, the 2nd lien route will make more sense because we’re only a few years removed from the lowest interest rate of all time. However, as time goes on and our equity grows (and market interest rates drop), cash-out refinances start making more sense.

Note that these scenarios are based on lowering your total interest cost, and it assumes the 2nd lien is a fixed mortgage, not a line of credit. There are other reasons why you’d want to do a cash-out refinance over a second lien, such as to remove someone from the mortgage, because it’s easier to qualify, etc.

HELOAN VS HELOC

A Home Equity Loan (HELOAN) is basically a 2nd mortgage on the property and is structured the same as a 1st mortgage; your monthly payment is the same each month, and the loan closes out once the balance goes down to $0.

A Home Equity Line of Credit (HELOC) is like a credit card; you can borrow up to a limit, your monthly payment is based on what the current balance is, you can pay down and borrow up to the limit repeatedly (i.e. having a $0 balance doesn’t close out the loan), and the interest rate is usually variable (but sometimes can be fixed) depending on what the current market rates are.

When you get a HELOC, there is a draw period (usually 5–10 years) in which you can continue using it like a revolving line of credit, and then it converts to a fixed repayment period (10–20 years) where it feels more like a HELOAN.

Most people instinctively think HELOCs are better than HELOANs because you can get it and let it sit and only pay interest when you use the money, but I do want to call out some disadvantages to HELOCs:

- Your initial interest rate on a HELOC is usually higher than a HELOAN

- Floating interest rates mean your monthly payments can spiral out of control

- Revolving credit lines have a negative impact on your credit when you max them out

- HELOCs can get frozen when the market turns (this happened to a lot of people during the 2008 crash), and the liquidity you thought you had is no longer available

Because of this, I only recommend HELOCs when you know you can pay it back within a year. For example, doing a fix-n-flip, doing a BRRRR (where you can cash-out refinance to pay back the HELOC), doing a short-term loan to someone, etc. If you’re pulling out money to use as a down payment on a turnkey property, I’d recommend a HELOAN because you won’t be able to pay it back right away and thus would expose yourself to the disadvantages I mentioned.

DIFFERENT TYPES OF 2ND LIEN LOAN PRODUCTS

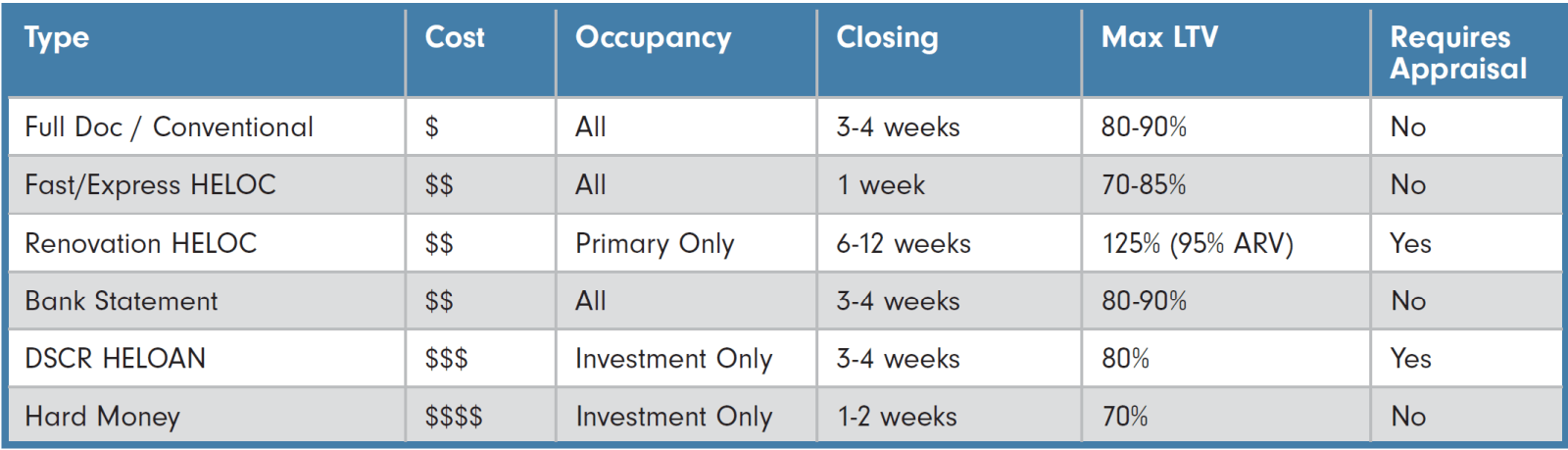

Most people only know about the debt-to-income (DTI) based HELOCs and HELOANs, but there is more out there. Note that most of these come in both HELOC and HELOAN forms, unless I specifically state that it’s only available in one form. LTVs will vary as the market changes and by lender, but I’ve listed what I’m seeing now. Remember that all of these can be done as a 1st lien as well (and would generally be priced better).

FULL DOC HELOC/HELOAN

This is the most common type of HELOC/HELOAN. It’s underwritten with the same guidelines as a conventional mortgage. These come in all flavors (sometimes going up to 100% LTV), and generally, your best pricing is going to come from a credit union or local community bank.

Sometimes you might be required to take an initial draw, which you may need to keep outstanding for a few months before you can pay it down and fully utilize it like a line of credit. You might also need to pay points and closing costs, which is why non-bank options are more expensive. However, they also offer more flexibility and higher LTVs and loan amounts than the local banks and credit unions, who often do not do HELOCs on rentals.

FAST/EXPRESS HELOC

This is still a DTI-based product, but it’s completely digital, and there is very minimal documentation. Normally, you just submit an ID and something to verify income, whether it be your bank accounts, tax returns, or pay stubs.

When I say this is fast, I mean you can literally apply in the morning, get approved during lunchtime, and sign closing docs in the afternoon.

Since there is limited underwriting done on these HELOCs, sometimes you can qualify for this HELOC even if you couldn’t qualify for the standard conventional HELOCs. For example, some of these HELOCs will take the income of both husband and wife, but only one person’s debts, which completely changes the DTI and allows you to do some creative debt planning. This HELOC can also take the form of a 3rd lien, but the LTV is capped at 70%.

RENOVATION HELOC

It’s insane to see a HELOC that can go as high as 125% LTV, but that’s because this HELOC also looks at the ARV (and caps it at 95%). This is great for folks who are doing BRRRR or adding an ADU. However, it is probably the most painful to get (as you can see from its closing timeframe) because there is heavy vetting of the contractor and your scope of work. If you are acting as your own GC, then every single sub will need to be vetted.

There is a big advantage to this type of renovation loan compared to others, such as 203k, HomeStyle Renovation, hard money, or construction loans: once you get this HELOC, there is no inspection at each draw; you get a checkbook and you can just write out checks.

A big downside is that it’s only available on your primary residence.

BANK STATEMENT HELOC/HELOAN

This product is great for business owners who bring in a lot of gross revenue but not necessarily net profit, and can’t normally qualify using tax returns (because you’re writing off too many things). It derives income by looking at average monthly deposits over the last 12 or 24 months and does not look at expenses at all.

To illustrate how this would be more beneficial than a conventional DTI underwriting, I had a client who owned a gas station. His monthly gross revenue was about $200k, but his monthly expenses were about $180k, so

his actual net profit was $20k/month. However, the bank statement route only sees his $200k revenue and applies a standard 50% expense ratio to it, thus, his net income is now $100k/month. He can qualify for a lot more loans now.

DSCR HELOAN

This is a 2nd lien that’s based entirely on the property’s cash flow, which is great for folks who don’t have a lot of personal income. I won’t spend too much time talking about this one since I already wrote a long post about DSCR loans before. The DSCR here is calculated by taking the rent divided by both the first lien payment and the second lien payment.

Investors love DSCR loans, but these days it’s tough to get the max loan amount on a regular 1st lien DSCR loan because the higher interest rates make it hard to cashflow. It’s even harder on a 2nd lien because the rates are even higher (often in the low double digits). There is also no “low ratio” or “no ratio” option here; it must meet a DSCR of at least 1.00x, which means the rents must cover the payments of both the 1st and 2nd liens.

This option works better on an Airbnb or on a rental property in the Midwest that cashflows well on long-term rents, but make sure the equity is big enough to support a loan of at least $100k.

HARD MONEY HELOC/HELOAN

This is great for folks who:

- Can’t show a lot of income to qualify for the other types of 2nd lien loans

- Have bad credit (since this is the only option that doesn’t pull credit)

- Own non-residential properties (since all of the other 2nd lien options are only on 1–4 unit properties)

- Own properties in an LLC

- Want to put multiple properties together to get a higher loan amount

However, it’s also the most expensive option and the only 2nd lien that is short-term. So, before you get one of these, make sure you have a good exit strategy to pay off the loan within 1–2 years!

If you’re thinking about pulling cash out of a property and aren’t sure which route makes the most sense, feel free to reach out—I’m happy to run the numbers and help you strategize!

Flynn Family Lending is a local private lending company based in Renton, WA specializing in creative financing solutions. We help real estate investors unlock equity and seize opportunities quickly—without the red tape of traditional lenders. Please visit our website at www.flynnfamilylending.com to learn more, or you can contact us at sales@flynnfamilylending.com or 1-833-359-6648.