When (and How) Does a Lease Need to be Notarized?

From time to time, members write in with questions and confusion about when a lease needs to be notarized. Do the signatures of both the tenant and landlord need to be notarized? Wasn’t there a new law last year that changed this? This Support Center article explains.

Notarize Lease with Terms Greater than One Year

Washington State law RCW 59.18.210 dictates that Residential lease agreements longer than one year in length must be in writing, with the landlord’s signature acknowledged by a notary public (or other authorized person) to be valid. In the absence of an acknowledgment on the landlord’s signature, the general rule is that the lease is treated as one from month to month.

In 2024, SB 5840 removed this notary requirement for commercial properties only. The bill includes the following language: "Nothing in this section shall be construed in any manner to conflict with or supersede RCW 59.18.210."

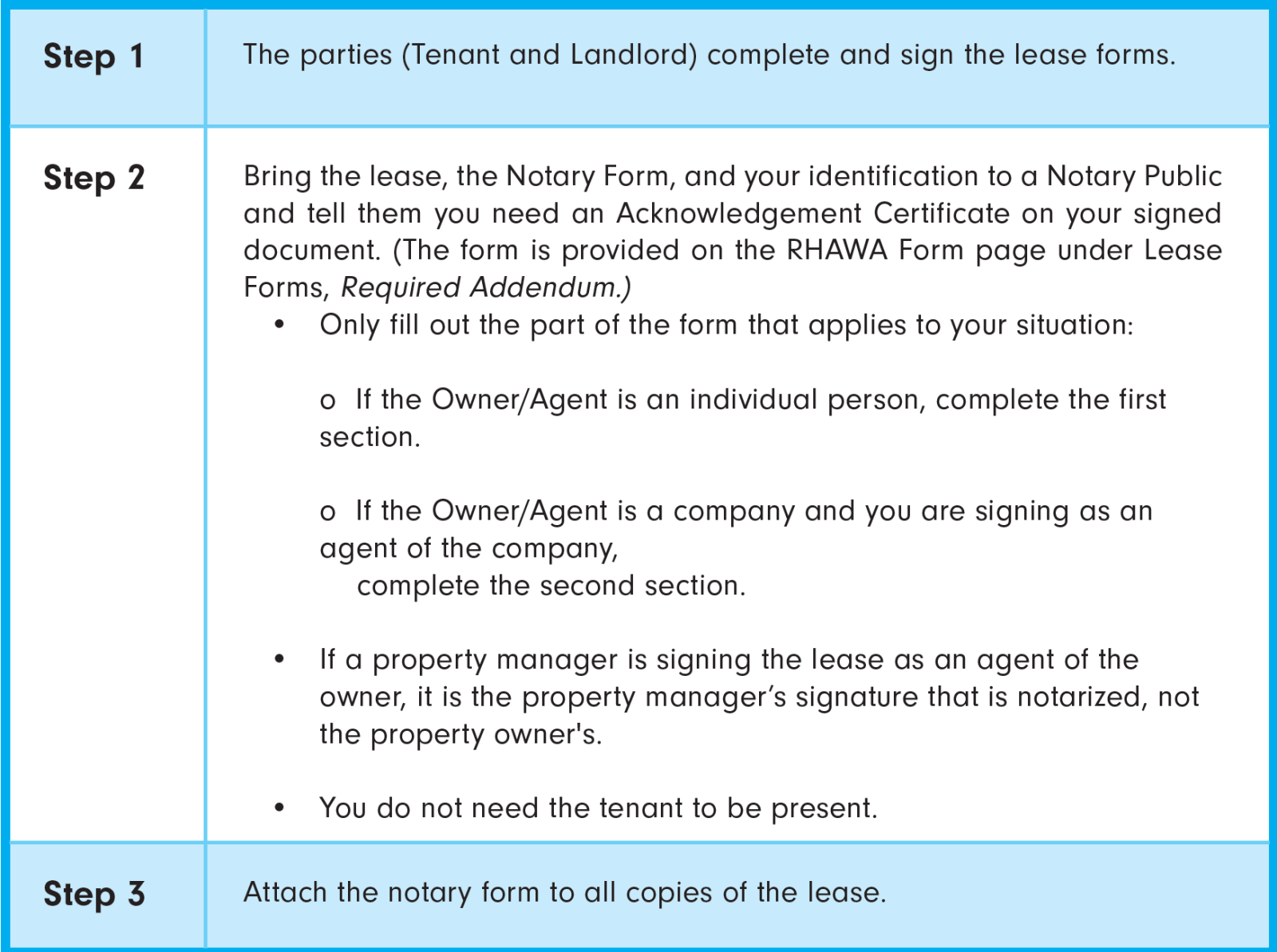

RHAWA provides a Notary Form for notarizing leases, which is listed as a required addendum on the Lease forms. After the tenant has signed the completed lease form, take the lease, the Notary Form, and your identification to a Notary Public and tell them you need your signature acknowledged, using the Acknowledgement Certificate. The Notary Form provides two different sections: Use the first section if the Owner/Agent is an individual person, or use the second section if the Owner/Agent is a company and you are signing as an agent of the company. Make sure to use the appropriate section of the form. Note that if a property manager is signing the lease as an agent of the owner, it is the property manager’s signature that is notarized, not the property owner's.

How to Set Up a Lease Term Over One Year

Table 1: A summary of the procedure to set up a lease term for a duration longer than one year.

Background

People often mistakenly believe that both the tenant's and landlord's signatures need to be notarized. (In fact, an older version of RHAWA’s form included a space for the tenant’s signature to be notarized.) An explanation of the requirements is found under real estate law regarding conveyances. A conveyance is the transfer and assignment of any property right or interest from one individual or entity (the conveyor) to another (the conveyee). RCW 64.04.010 spells out that whenever an owner conveys their property to another entity or places an encumbrance upon it, this must be done by “deed,” which RCW 64.04.020 says shall be “in writing, signed by the party bound thereby, and acknowledged ….”

Since a leasehold is an “encumbrance,” it must be in the form of a deed unless some other statute makes it exempt, as is the case for periodic (month-to-month) tenancies and lease terms less than one year. Because a deed must be signed and acknowledged only by the grantor, only the landlord needs to sign or acknowledge a lease to meet the requirement under RCW 59.18.210. Obviously, there are many other factors that require the tenant’s signature on a lease, but it does not need to be notarized.

Many people also ask about the need to include a description of the property. This requirement is met by the lease agreement itself where the premises is described, usually simply by the street address or the description of the property found in the county tax parcel database.

REFERENCES

• RCW 59.18.210 - Tenancies from year to year except under written contract

• SUBSTITUTE SENATE BILL 5840 Chapter 27, Laws of 2024

• RCW 64.04.010 - Conveyances and encumbrances to be by deed

• RCW 64.04.020 - Requisites of a deed

• RCW 64.08 – Acknowledgements

• Ricards v. Redelsheimer, 36 Wash. 325, 78 P. 934 (1904)

Formal legal advice and review are recommended prior to the selection and use of this information. RHAWA does not represent your selection or execution of this information as appropriate for your specific circumstance. The material contained and represented herein, although obtained from reliable sources, is not considered legal advice or to be used as a substitution for legal counsel.